Notepad investing.

Your One-Stop Solution for All Wealth Management Needs

At Notepad Investing, our mission is simple:

Building Tomorrow’s HNIs. Protecting Today’s.

Model portfolio

➢ Time Horizon : 3+ YEARS

➢ Benchmark : NIFTY 500 TRI

➢ No. of stocks : 30 Stocks + 2 ETFs

➢ Min Allocation : ₹ 2,00,000

| Returns | YTD | 1Y | 3Y | 5Y | P/E | P/B | DIVIDEND |

|---|---|---|---|---|---|---|---|

| ALGO | 7.6% | −16.4% | 22.4% | 20.0% | 43.93 | 6.42 | 0.65 |

| NIFTY | 4.65% | -4.64% | 12.85% | 16.97% | 21.76 | 3.37 | 1.35 |

Mutual Funds & ETFs

At Notepad Investing, we recommend mutual funds only after clearly understanding your goals, risk appetite, and investment time horizon.That said, we also have certain structured approaches that help align investments with long-term financial outcomes.

ACTIVE INVESTING

| FUNDS | 1Y | 3Y | 5Y |

|---|---|---|---|

| Value | 2 | 3 | 4 |

| Focused | 2 | 3 | 4 |

| Growth | 2 | 3 | 4 |

| Aggressive | 2 | 3 | 4 |

ALTERNATE INVESTING

| FUNDS | 1Y | 3Y | 5Y |

|---|---|---|---|

| GOLD | 2 | 3 | 4 |

| SILVER | 2 | 3 | 4 |

| REITS | 2 | 3 | 4 |

| INVITS | 2 | 3 | 4 |

| BONDS | 2 | 3 | 4 |

PASSIVE INVESTING

| FUNDS | 1Y | 3Y | 5Y |

|---|---|---|---|

| Stable | 2 | 3 | 4 |

| Growth | 2 | 3 | 4 |

| Smart Beta | 2 | 3 | 4 |

| Momentum | 2 | 3 | 4 |

PMS

Aligned With You. Invested With You.

Every PMS we recommend is something we personally use in our own portfolios.

HUF

What is an HUF?◾️ The full form of HUF is Hindu Undivided Family.

◾️ It is a separate legal entity under the Income Tax Act, created for tax purposes.

◾️ This is one of the tax saving strategies legally available to joint families.

◾️ An HUF can own property, earn income, invest and claim tax benefits independent of its members, helping families reduce their overall tax liability by legally splitting income.

◾️ The head of the HUF is called the Karta, while the family members are coparceners.

Turn Your Family Into a Tax-Efficient Entity.

Key Benefits of an HUF◾️ Earn additional ₹8,00,000 to ₹10,00,000 income tax-free each year.

◾️ Additional life cover for the Karta with Tax free retuns.

◾️ Legitimate business & travel expense claims.

◾️ Rent, electricity, and transport bills can be paid through the HUF and deducted from Income.

◾️ Salaries can be paid to non-taxpaying family members i.e. Children, Spouse, Parents, Cousins etc.

◾️ GLOBALexposure through HUF investments upto $200,000.

◾️ Protect Family assets from external risks of legal, personal or marital in nature.

| Income Tax Slabs | Income Tax Rates |

|---|---|

| Up to Rs. 4 lakhs | Nil |

| Rs. 4 lakhs to Rs. 8 lakhs | 5% |

| Rs. 8 lakhs to Rs. 12 lakhs | 10% |

| Rs. 12 lakhs to Rs. 16 lakhs | 15% |

| Rs. 16 lakhs to Rs. 20 lakhs | 20% |

| Rs. 20 lakhs to Rs. 24 lakhs | 25% |

| Above Rs. 24 lakhs | 30% |

| Income from Various Sources | Income of Mr. Chopra before formation of HUF | Income of Mr. Chopra after formation of HUF | Income of HUF |

|---|---|---|---|

| A) Salary | 20 lakhs | 20 lakhs | - |

| B) Passive Income from FDs, Bonds | 10 lakhs | - | 10 lakhs |

| C) 20% STCG OR Income Slab taxes FD interest | (2,00,000) | – | (30,000) |

| D) Income from other sources (B-C) | 8,00,000 | – | 10,00,000 |

| Total Taxable Income (A+D) | 30 Lakhs | 20 Lakhs | 10 Lakhs |

| (-) Standard Deduction | (75,000) | (75,000) | - |

| Net Taxable Income | 29,25,000 | 19,25,000 | 10,00,000 |

| Tax Payable | 3,92,400 | 1,92,400 | 30,000 |

| In Hand | 25,32,600 | 17,32,600 | 9,70,000 |

| Savings | - | 1,70,000 | Tax Saved |

Working of HUF

Sample Calculation for a Family of 3

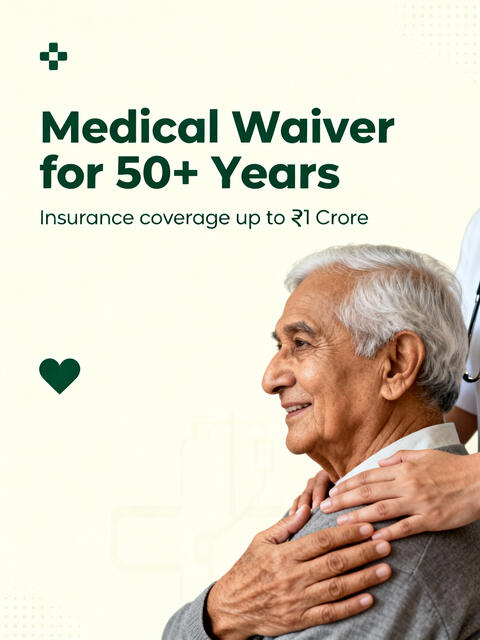

Insurance

🔰 The 3 Most Important Insurances You Must HaveBefore you think about investing, you must first protect your financial foundation.

These three insurances are essential for every family.

1️⃣ Life Insurance (Term Plan)Your income supports your entire family — protecting it is non-negotiable.

A term plan ensures your family remains financially secure even in your absence.It is the lowest-cost, highest-benefit insurance product you can buy.

Pure protection — no returns, no complexities.

2️⃣ Health InsuranceA single hospitalisation can wipe out years of savings.

With medical inflation rising 12–14% annually in India, depending only on employer coverage is dangerous.A strong personal health insurance plan safeguards both your health and your wealth.

3️⃣ Mandatory / Third-Party InsurancesMotor insurance, liability insurance, and profession-specific covers are legally required.

Ignoring them can lead to penalties, financial losses, and unnecessary risk.Every responsible individual should stay compliant and fully protected.

my team

Manthan Jain — Founder (CFP®, SEBI-Registered Research Analyst)

Leads overall strategy, client advisory, and portfolio design with expertise in wealth management, tax planning, and behavioral finance.CA Pranay Oswal — Tax & Compliance

Handles taxation, accounting, and compliance structures for HNI and family office clients.Neha Das — Brand & Growth Strategist

Manages marketing, communication, and digital presence to build a clear and trustworthy brand.Adv. Mukesh Jain — Legal & Estate Advisor

Expert in wills, trusts, and estate planning, ensuring clients’ assets are well-protected and structured.Payal Mukherjee — Insurance & Risk Consultant

Creates personalized insurance and risk-management plans tailored to each client’s financial goals.

| Title | Author | Year | ISBN |

|---|---|---|---|

| Neuromancer | William Gibson | 1984 | 0-441-56956-0 |

| Snow Crash | Neal Stephenson | 1992 | 0-553-08853-X |

| Software | Rudy Rucker | 1982 | 0-441-77408-3 |